Articles and Updates

December 2023

The Basics of FLEX Options

The options market has a variety of products, designed for different strategies and risk profiles, and among these are flexibly structured options -- also known as FLEX options, or FLexible EXchange® Options.

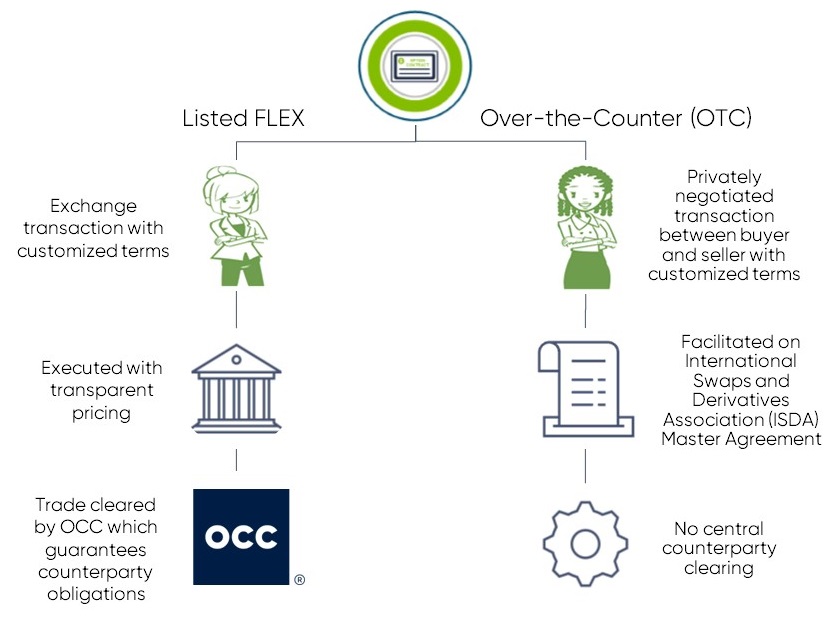

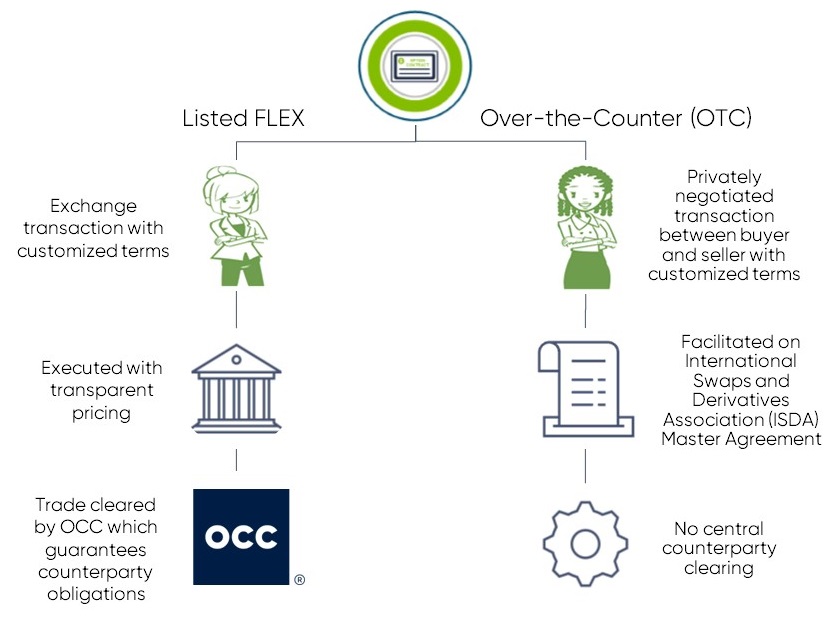

In 1993, FLEX options were introduced to offer a listed alternative to customizable options traded over-the-counter (OTC), where transactions occur directly between counterparties rather than on an exchange. Much like OTC trades, FLEX options allow investors to define contract terms, including exercise style, expiration date, strike price, contract size, and occasionally the deliverable. Notably, FLEX options differ from OTC options in that they have the benefits of being exchange-listed and their trades are cleared by the Options Clearing Corporation (OCC).

In the process of clearing exchange-listed options, including FLEX options, OCC functions as the buyer for every option seller and the seller for every option buyer. This systematic approach is designed to reduce counterparty risk. Simultaneously, exchanges provide transparency and foster competitive markets for options, a feature often lacking in the more opaque over-the-counter (OTC) trades.

To qualify as a listed FLEX option, there are a few requirements must be met, including:

For FLEX options, the trade process requires a distinct method, namely the submission of a ‘request for quote,’ or RFQ. An RFQ is mandatory for both quoting a trade and to update the bid/ask spread on an existing FLEX. Unlike non-flex options, FLEX option prices are not distributed through a chain; instead, FLEX information can be accessed through the listing exchange and the OCC website.

When an investor decides to initiate a FLEX trade, after determining the contract terms for the trade, they will subsequently reach out to their broker with the terms. The broker then seeks a quote by submitting a request for quote (RFQ) to the exchanges. The RFQ includes the required details such as the underlying asset, option type (call, put, or both), settlement type, expiration date, strike price, exercise style, and deliverable.

The RFQ may solicit a two-sided quote or request either a bid or an offer. After receiving the quote, the investor can execute a trade based on the provided quote or engage in negotiations to reach a mutually acceptable price. Because of this process, investors should be aware that the market for FLEX options will likely be less liquid than the market for standard options.

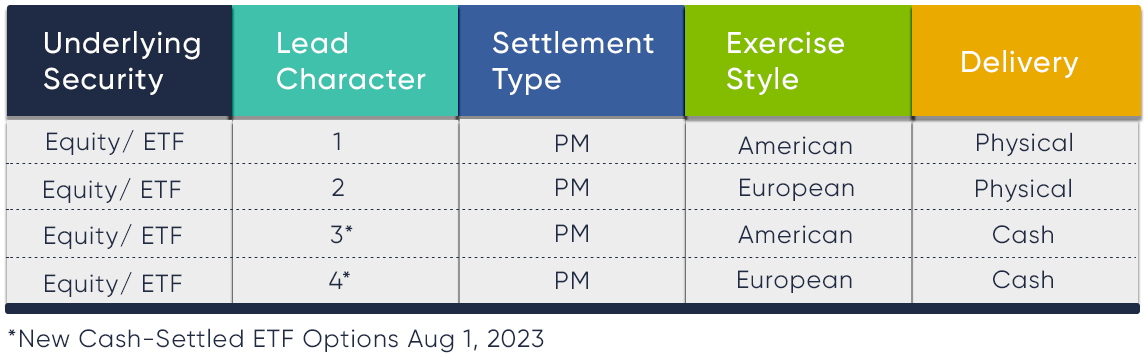

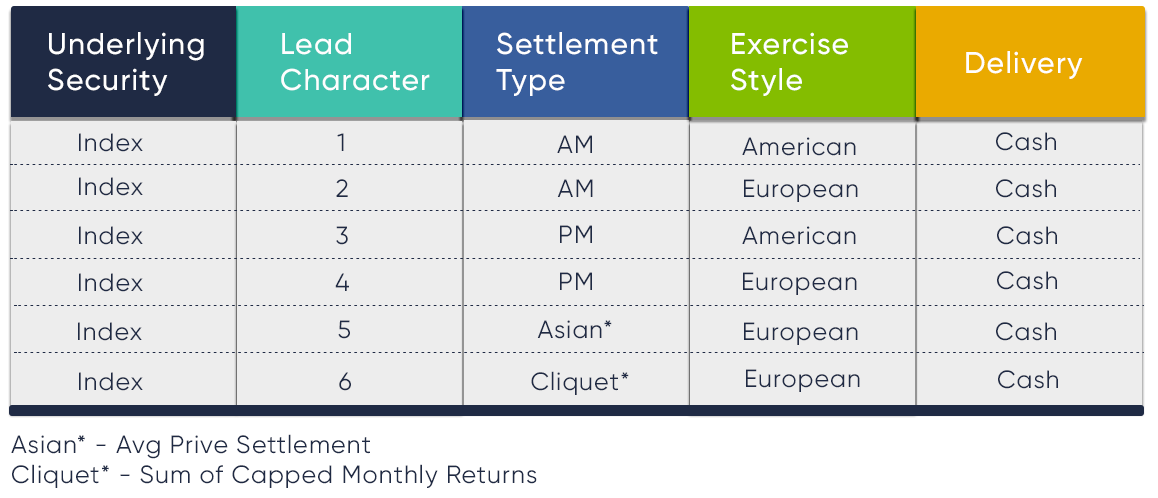

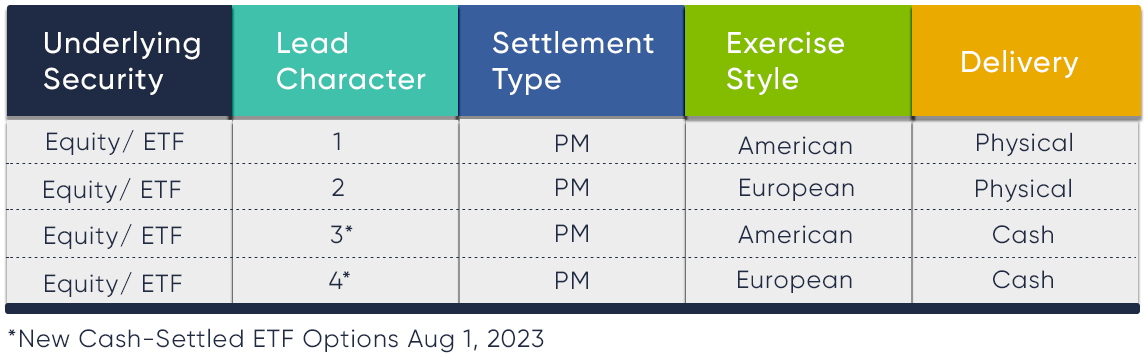

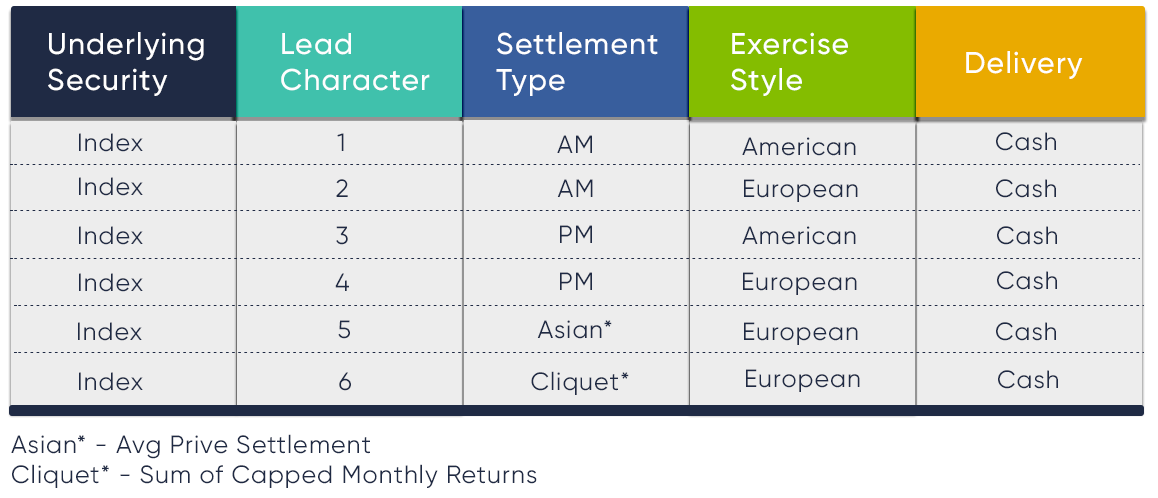

When the RFQ process is completed, a unique option symbol is created based on the FLEX option contract terms and the suitable symbology. FLEX symbology is summarized below:

Non-flex options are limited to expirations lasting no more than 2.5 years. If an investor wants to extend expiration, a FLEX option may be considered. With FLEX options, an investor can replicate the terms of a non-flex option while adding an extended expiration up to 15 years.

When a FLEX option approaches an expiration within the 2.5-year limit, there is a possibility that a newly listed non-flex option will have identical terms to an existing FLEX option. In such cases, the FLEX option is converted into the non-flex option. This is done by transferring the existing FLEX open interest into the identical non-flex option symbol. The converted FLEX option, now bearing the new non-flex symbol, integrates into the option chain with continuous quoting, enabling electronic trading without any additional action taken by the investor. An example of this OCC FLEX consolidation Information Memo can be found here.

In summary, FLEX options provide participants with the advantages of customization and the benefits of exchange-traded options facilitated by OCC clearing. The caveat of trading FLEX options is the unique constraints required to facilitate the flexibility; including the necessity of an RFQ, the absence of continuous quotes, and the availability of trade data found only on the listing exchanges and on the OCC website.

In 1993, FLEX options were introduced to offer a listed alternative to customizable options traded over-the-counter (OTC), where transactions occur directly between counterparties rather than on an exchange. Much like OTC trades, FLEX options allow investors to define contract terms, including exercise style, expiration date, strike price, contract size, and occasionally the deliverable. Notably, FLEX options differ from OTC options in that they have the benefits of being exchange-listed and their trades are cleared by the Options Clearing Corporation (OCC).

FLEX Options Listing and Clearing Overview

In the process of clearing exchange-listed options, including FLEX options, OCC functions as the buyer for every option seller and the seller for every option buyer. This systematic approach is designed to reduce counterparty risk. Simultaneously, exchanges provide transparency and foster competitive markets for options, a feature often lacking in the more opaque over-the-counter (OTC) trades.

To qualify as a listed FLEX option, there are a few requirements must be met, including:

- The minimum size must be one contract.

- Strike prices may be in penny increments or in the equivalent of a percentage of the underlying.

- Premiums may be in dollars and cents or in percentages of the underlying.

- Expiration dates can be any business day, up to 15 years in the future.

- Expiration may be American- or European-style.

- The deliverable for some FLEX ETF options may be cash as permitted by certain exchange rules.

For FLEX options, the trade process requires a distinct method, namely the submission of a ‘request for quote,’ or RFQ. An RFQ is mandatory for both quoting a trade and to update the bid/ask spread on an existing FLEX. Unlike non-flex options, FLEX option prices are not distributed through a chain; instead, FLEX information can be accessed through the listing exchange and the OCC website.

The FLEX Options RFQ Process

When an investor decides to initiate a FLEX trade, after determining the contract terms for the trade, they will subsequently reach out to their broker with the terms. The broker then seeks a quote by submitting a request for quote (RFQ) to the exchanges. The RFQ includes the required details such as the underlying asset, option type (call, put, or both), settlement type, expiration date, strike price, exercise style, and deliverable. The RFQ may solicit a two-sided quote or request either a bid or an offer. After receiving the quote, the investor can execute a trade based on the provided quote or engage in negotiations to reach a mutually acceptable price. Because of this process, investors should be aware that the market for FLEX options will likely be less liquid than the market for standard options.

When the RFQ process is completed, a unique option symbol is created based on the FLEX option contract terms and the suitable symbology. FLEX symbology is summarized below:

FLEX Options Consolidation

Non-flex options are limited to expirations lasting no more than 2.5 years. If an investor wants to extend expiration, a FLEX option may be considered. With FLEX options, an investor can replicate the terms of a non-flex option while adding an extended expiration up to 15 years.When a FLEX option approaches an expiration within the 2.5-year limit, there is a possibility that a newly listed non-flex option will have identical terms to an existing FLEX option. In such cases, the FLEX option is converted into the non-flex option. This is done by transferring the existing FLEX open interest into the identical non-flex option symbol. The converted FLEX option, now bearing the new non-flex symbol, integrates into the option chain with continuous quoting, enabling electronic trading without any additional action taken by the investor. An example of this OCC FLEX consolidation Information Memo can be found here.