Articles and Updates

May 2024

Understanding the Life Cycle of an Option Trade

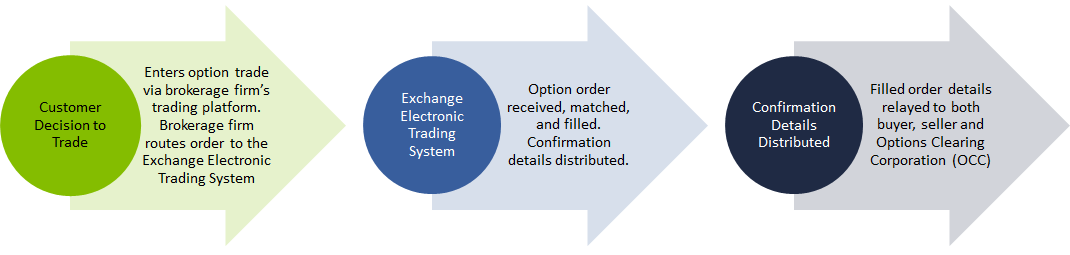

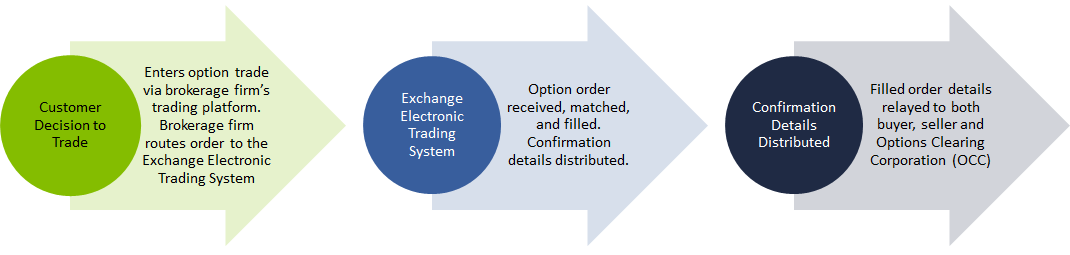

The life cycle of an option trade starts once an investor, with an approved option trading account, and who has placed an order for a trade receives a fill notification for an option order that was entered into a trading platform, routed to, and then subsequently filled on an options exchange. Even though that process may appear straightforward, the reality is more complex than the summary suggests.

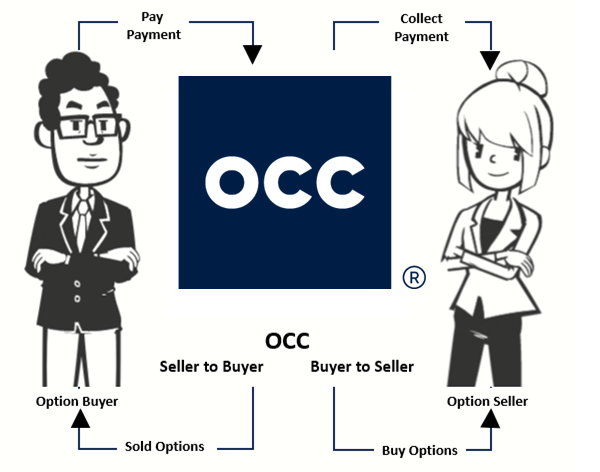

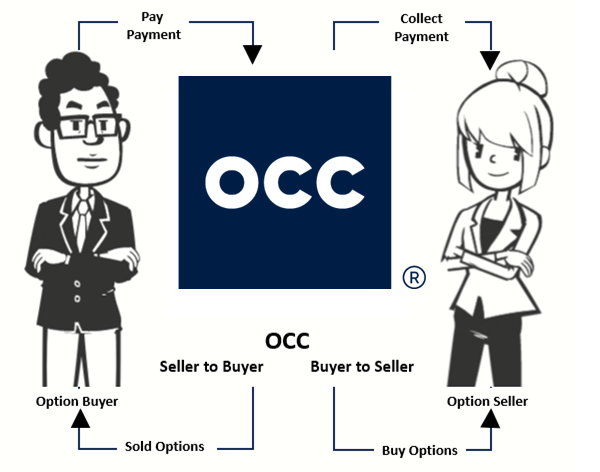

With every one of the millions of options contracts traded per day, there are numerous required steps and participants operating behind the scenes to ensure that each contract makes it all the way through to settlement. An investor’s brokerage firm typically facilitates an option trade through an electronic trading platform that routes orders to an options exchange or to multiple exchanges. The exchange's primary role is to match orders between an options buyer and an options seller. Once the trade is matched and the order is filled, and confirmed by the brokerage firm, the transaction enters the settlement and clearing phase. During this phase, trade details are transmitted, funds are transferred between the buyer and the seller; and the Options Clearing Corporation (OCC) established the options position in its system. During the clearing and settlement process, OCC becomes the buyer to every seller and the seller to every buyer as the central counterparty (CCP), helping to safeguard the rights of buyers and ensure the obligations of sellers are met throughout the exercise and assignment process.

An investor’s brokerage firm typically facilitates an option trade through an electronic trading platform that routes orders to an options exchange or to multiple exchanges. The exchange's primary role is to match orders between an options buyer and an options seller. Once the trade is matched and the order is filled, and confirmed by the brokerage firm, the transaction enters the settlement and clearing phase. During this phase, trade details are transmitted, funds are transferred between the buyer and the seller; and the Options Clearing Corporation (OCC) established the options position in its system. During the clearing and settlement process, OCC becomes the buyer to every seller and the seller to every buyer as the central counterparty (CCP), helping to safeguard the rights of buyers and ensure the obligations of sellers are met throughout the exercise and assignment process.

Before a long option holder decides to exercise an option contract, there are number of factors to consider, including:

Every trade follows a journey from start to finish. In the world of options, understanding the process and the role of OCC beyond option buyers and sellers provides a perspective on the life cycle of an option from initiation through settlement including exercise and assignment. In essence, investors initiate trades, brokerage firms facilitate them, and clearinghouses provide clearing and settlement services.

With every one of the millions of options contracts traded per day, there are numerous required steps and participants operating behind the scenes to ensure that each contract makes it all the way through to settlement.

Exercise and Assignment

Equity and exchange-traded fund (ETF) options are generally American-style options which means they may be exercised at any time before their expiration date. This allows buyers the right to exercise at any time prior to expiration while option sellers may be called upon at any time to fulfill their obligations, if assigned.Before a long option holder decides to exercise an option contract, there are number of factors to consider, including:

- Before expiration: An American style option holder has the right to exercise an option before its expiration. Should they choose to do so, an option holder must submit an exercise notice to their brokerage firm along with instructions. These instructions are then relayed to OCC which in turn triggers the assignment process.

- On expiration: OCC administers the automatic exercise process, which occurs when an option contract is a penny or more in-the-money. This procedure is also known as exercise-by-exception, or ex-by-ex. Even when expiring options meet these criteria, the options will not be automatically exercised if contrary instructions are received by OCC.

- Contrary Exercise Advice: A long options holder has the right to exercise as well as the right to not exercise an options contract. This is especially important on an option’s expiration date when the ex-by-ex process is applied. The holder of a long in-the-money (ITM) option at expiration may decide not to exercise whereas the long out-of-the-money (OTM) option holder may decide to exercise their option contract. In either circumstance, a ‘contrary exercise’ notice instructing OCC that the option holder elects not to follow the Ex-by-Ex procedure must be submitted to the OCC by the defined time deadline.

Exercises Notices Generate Assignments

When an option writer is assigned, they must fulfill the obligation associated with the option contract. To ensure fairness in the distribution of option assignments, OCC utilizes a random method to assign a clearing member firm with a corresponding short option position to the exercise of a long option position. The assigned clearing member will then utilize their own assignment method to allocate the assignment to individual accounts who are short these options. An assignment triggers the seller’s obligation to fulfill the terms of the contract by either selling (for a call) or buying (for a put) the underlying security at the strike price.

Every trade follows a journey from start to finish. In the world of options, understanding the process and the role of OCC beyond option buyers and sellers provides a perspective on the life cycle of an option from initiation through settlement including exercise and assignment. In essence, investors initiate trades, brokerage firms facilitate them, and clearinghouses provide clearing and settlement services.